Recommended Advice To Picking Gold Bohemia

Wiki Article

What Factors Should I Take Into Consideration When Buying Gold Bullion And Coins In Czech Republic?

If you're thinking of investing in gold-based coins and bullion in Czech Republic, there are certain aspects that need to be considered. Recognized institutions and dealers who are authorized ensure authenticity and high-quality.

Purity and Weight - Verify the purity and weight. Gold is sold in a variety of weights and purity (e.g. 24 Karat, 22 karat and so on.). It must meet standard specifications.

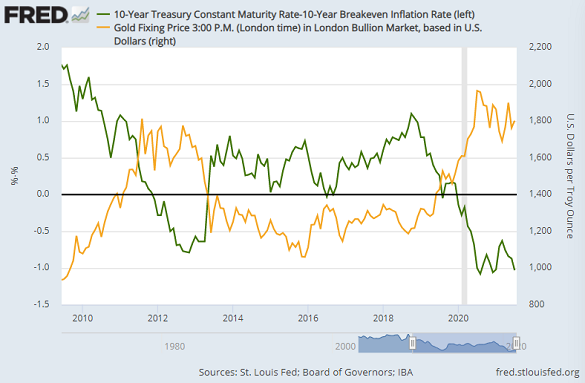

Understanding pricing and the premiums. This means understanding the price structure for gold as well as the prices charged by dealers. Compare prices from different sellers to ensure that you get the highest return on your investment.

Storage and Security Think about safe and secure options to store your gold. Some investors prefer storing with banks or in a special facility because of security concerns.

Liquidity, and Selling Options- Consider the ease of being able to sell when you need to. Choose bullion or coins with high liquidity that are easily traded in the market. Have a look at the top rated our site on Prague coins for website info including euro coins, gold bullion price, gold apmex price, buy gold coins, valuable gold dollar coins, gold penny, agi stocks, gold pieces for sale, 1972 gold dollar, cost of silver coin and more.

How Can I Be Sure Of The Gold Coin I Purchase Is Of Good Quality? Or Bullion That I Purchase From Czech Republic?

The verification of the authenticity and document of gold bullion and other coins from the Czech Republic includes several steps.-

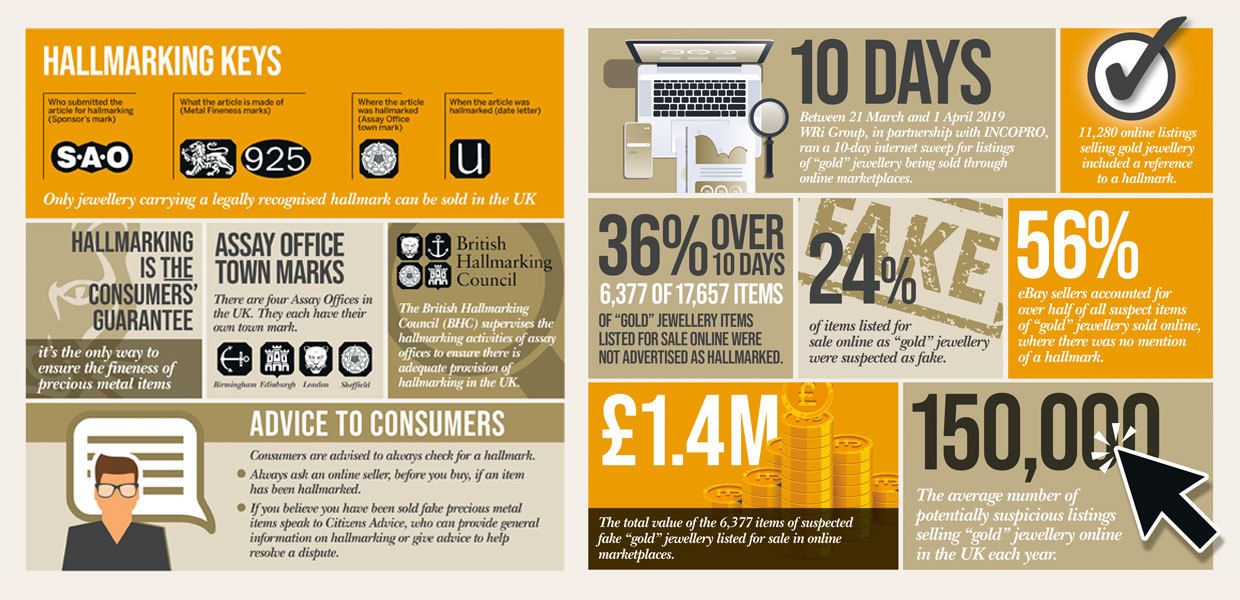

Certification and HallmarksSearch for official hallmarks or marks on gold objects. These hallmarks indicate the purity, weight and authenticity of the gold. They are usually provided by reliable assay offices or institutions of government. Verify the purity of the gold is pure by checking for karatages or marks. A piece of gold that is 24karat is considered pure. Lower Karatages, however, signify the different levels or alloys.

Gold from reputable sellers- Buy gold only from dealers who are reputable, established and authorized. These sellers usually offer appropriate documents, such as authentic certificates and receipts detailing the specifications of gold.

Ask for documentation - If you're buying gold, you should request authentic certificates or certificates of assay. These documents should include details about the purity of the gold weight, weight, manufacturer and the hallmark.

Independent Verification: Request an independent verification or appraisal by a third party expert. They can check the quality of the gold and determine its authenticity.

Verifying the authenticity of gold coins or bullion involves a combination of due diligence, trust in credible sources, and collection of appropriate documentation to make sure you're buying authentic and top-quality gold. Have a look at the best great site for gold price Bohemia for site advice including bullion depository, silver price in dollar, price of 1 oz of gold, buy gold and silver, 1oz gold, gold mining stocks, price for one ounce of gold, silver double eagle coin, purchase gold, investing in gold and silver and more.

What Is A Small Increase In The Price Of Stocks And A Modest Price Spread Of Gold?

In gold trading, low price markups and spreads are the expenses involved in purchasing or selling gold in comparison to the market price. These terms are used to describe the extra cost that you could be charged (markup) as well as the spread between selling prices and buying prices. Low mark-up refers to a dealer who charges an amount that is minimally higher than the market value. Low markup indicates that the price of gold you pay is near or just slightly higher than actual market value.

Low Price Spread The spread is described as the gap in gold's buying (bid) price and the selling (ask). A low spread means there is a small gap between these prices.

What Is The Average Price For Mark-Ups? Price Spreads Differ Across Gold Dealers?

Negotiability Some dealers are more inclined to negotiate markups and margins, especially for large transactions or customers who are repeat clients. Geographical location: Mark-ups and spreads may be affected by local factors, regional laws, and taxes. Dealers who are located in regions where regulatory and tax costs are higher may transfer these costs onto their customers through higher markups.

Product Types And Availability- The markups or spreads could vary based on the type of gold products you are buying (coins bars or collectibles,). Higher prices may be charged for rare or collectible items due to their rareness.

Market Conditions- If there is a huge demand for goods, a shortage or market volatility, dealers will increase their spreads as strategy to decrease risk or cover the losses.

Investors in gold must do their homework to find the top dealer. They must examine multiple prices and consider more than just mark-ups and spreads. Also, they should consider factors such as reputation, reliability, or customer service. Find the most competitive rates and compare quotes from a variety of sources. Take a look at the top rated official statement on Prague gold bars for site advice including gold dollar, $5 gold coin, buying gold online, gold coin price today, gold bullion bars, gold dollar coin, 1 10 ounce gold coin, price of 1 oz of gold, american eagle gold coin price, gold and silver coins and more.